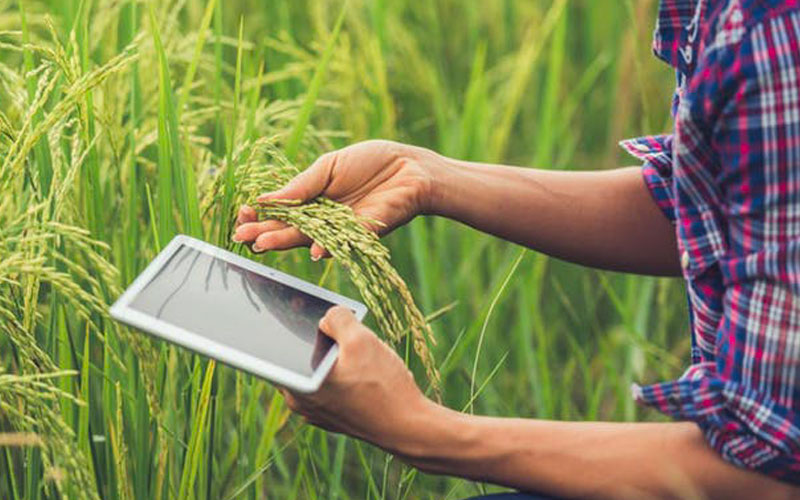

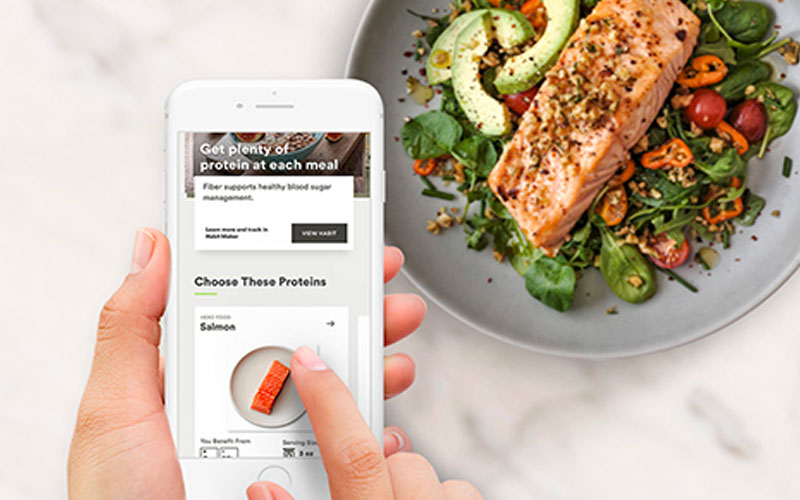

Sensors, biosensors and other technologies (e.g. GPS, GIS, drones) will be able to generate data by collecting signals and key indicators of quality and safety of foods, human health status, machinery, facilities (e.g. doors, windows), and environments. Sensors integrated into food smart packaging will communicate shelf-life status and facilitate traceability along the food value chain.

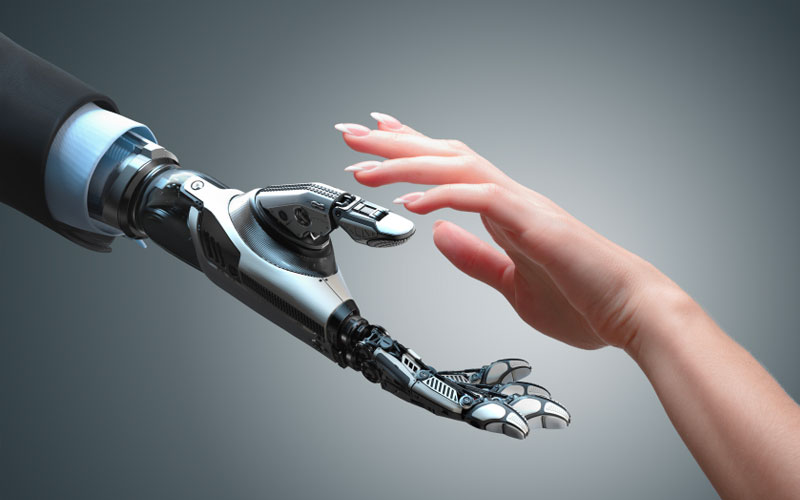

By the use of the next-generation network broadband and the growing impact of the digital economy in many other economic sectors, new related technologies will arise like the Internet of living things (i.e. networks of low-cost sensors, actuators and wireless networks for data collection and process monitoring of crops, livestock and agricultural eco-systems), the “decision support” (use of intelligent software that can perform planning tasks and support decision making and optimize large-scale production processes) and advanced robotics, with robots with enhanced senses, dexterity and intelligence used to automate tasks or augment humans (e.g. fruit harvesting; food manipulation automatic quality detection in food processing).

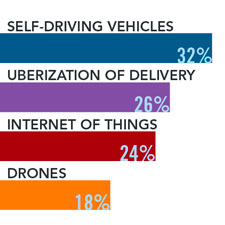

In agriculture and food processes, sensors and digital technologies will lead to autonomous farm vehicles able to navigate and operate with reduced or no human control to herd livestock and harvest crops, to the ‘Farms/food factory in the Cloud’ concept where data (or ‘big’ data) will be aggregated by algorithms to simulate real-time agricultural processes, as well as the “Internet of Farm/food factory Things” where objects that have access to the cloud will provide each other with services and communicate one each other.

Robotics, advanced sensors for sensing and control systems, has the potential to make overall the food processing and farming less labor-intensive, more resource-efficient and environmentally friendly. Automated drones with appropriate sensors can monitor large fields quickly and precisely.

Digital technologies and automation involve the ability to unlock the potential of big data. Competent experts and researchers and the use of emerging cognitive technologies and techniques of “deep learning” and “machine learning” will help them manage the vast amounts of data that will be generated and discover the key principles needed for a new science of sustainable management of agri-food and bioeconomy value chains.

For achieving smart industrial specialization and digital transformation of the agri-food production system a reskilling and upskilling the workforce is required.

Affected skills:

Technical skills (i.e. Technical skills in an adjacent technology domain or system (e.g. agriculture, food, life science, etc. like farming; food engineering, quality, risk, and safety); advanced manufacturing technologies, advanced materials, and nanotechnologies; skills for research and development of digital (e.g. micro-nano-electronics, photonics, and artificial intelligence) and cyber-technologies (e.g. digital security and connectivity); basic (e.g. digital user skills, DigComp Framework) and advanced (e.g. skills relevant to IT professionals’ occupations, e-competence) digital technology skills )

Technical skills (i.e. Technical skills in an adjacent technology domain or system (e.g. agriculture, food, life science, etc. like farming; food engineering, quality, risk, and safety); advanced manufacturing technologies, advanced materials, and nanotechnologies; skills for research and development of digital (e.g. micro-nano-electronics, photonics, and artificial intelligence) and cyber-technologies (e.g. digital security and connectivity); basic (e.g. digital user skills, DigComp Framework) and advanced (e.g. skills relevant to IT professionals’ occupations, e-competence) digital technology skills )

General skills (entrepreneurship, innovation skills)

General skills (entrepreneurship, innovation skills)

Soft skills (Communication, critical thinking, Management, leadership and entrepreneurial skills, ethics, and ethical behavior)

Soft skills (Communication, critical thinking, Management, leadership and entrepreneurial skills, ethics, and ethical behavior)

Future jobs: Nutrition scientists, microbiome administrator, bioinformatics, microbiome biologist, food ethics

TRENDS

TRENDS

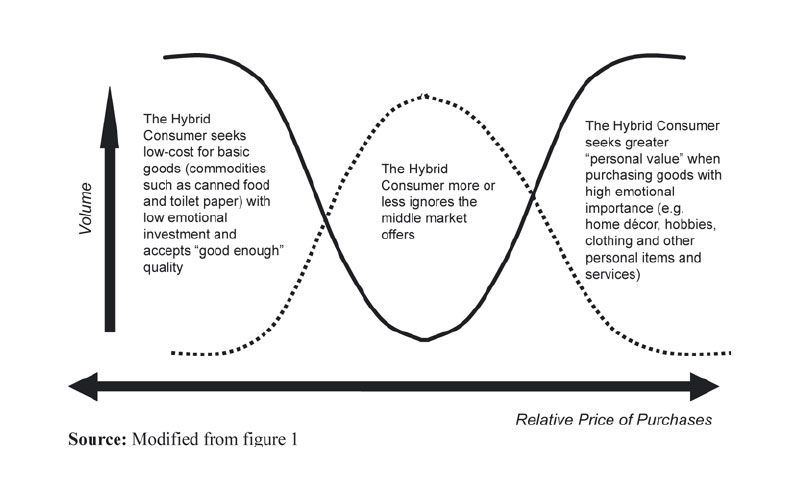

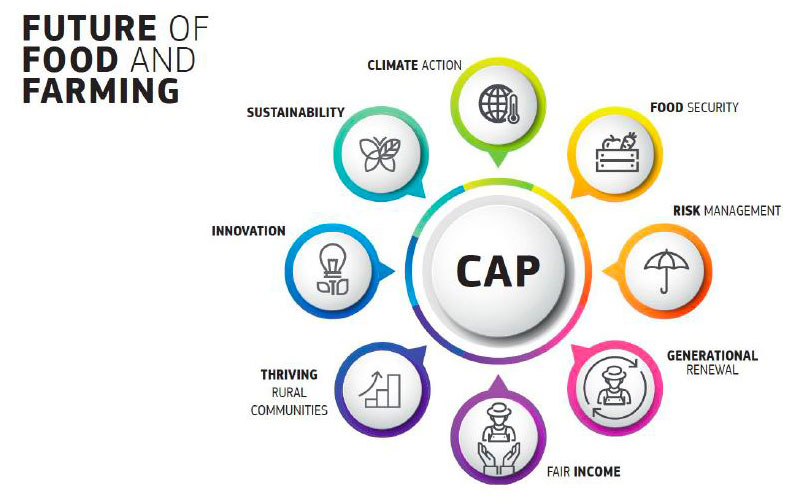

Different mixtures are changing the way to think about the food sector: it’s a new game-set, a different web altering the usual ways we consider the value chains.

Different mixtures are changing the way to think about the food sector: it’s a new game-set, a different web altering the usual ways we consider the value chains.